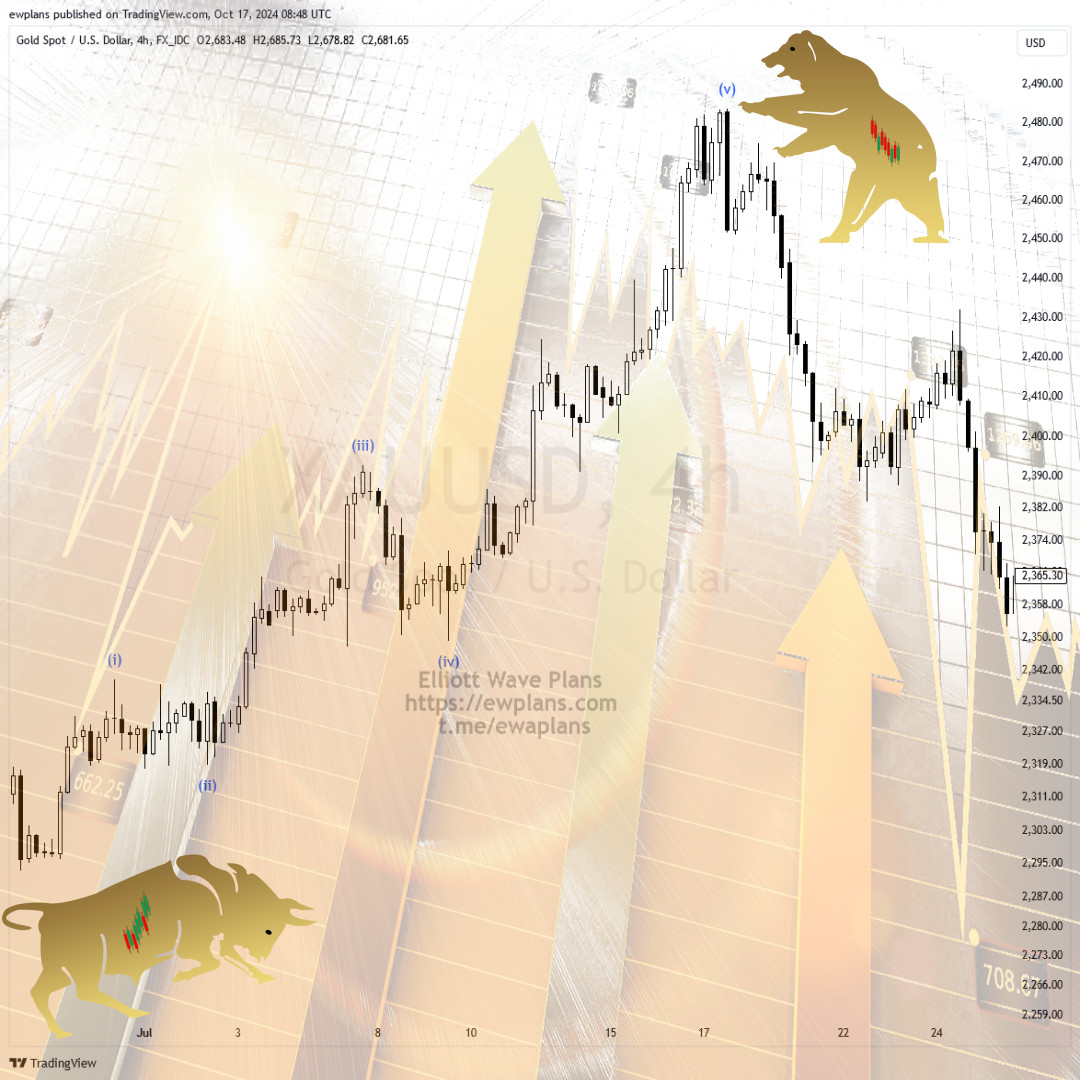

Elliott Wave Theory is one of the most powerful technical analysis tools used to understand and predict price movements in financial markets. The theory is based on the idea that prices move in rhythmic patterns, and these movements are organized into waves. These waves determine the market’s direction and help investors forecast future price movements.

The most important structure in Elliott Wave Theory is the 5-wave cycle. This cycle is defined by three impulsive waves (1, 3, and 5) that push the trend and two corrective waves (2 and 4) that temporarily move against the trend. In this article, we’ll take a deep dive into the structure and role of each wave.

1st Wave (Impulse)

The first wave represents the beginning of a new trend. It often occurs after a significant market decline when most investors believe the previous trend will continue. However, a few investors recognize the start of a new trend, making the 1st wave relatively weak and uncertain.

- Characteristics:

- A slow and steady rise/fall is observed.

- Most investors hold onto their positions, thinking the old trend will persist.

- The wave subdivides into 5 smaller waves (1-2-3-4-5).

2nd Wave (Corrective)

The second wave is a corrective wave that occurs as investors take profits from the first wave, questioning the new trend. It typically retraces much of the gains from the 1st wave but never exceeds the start of the 1st wave.

- Characteristics:

- A sharp and deep correction occurs.

- Many investors believe the market will re-enter the previous trend.

- The wave subdivides into 3 smaller waves (A-B-C).

3rd Wave (Impulse)

The third wave is often the strongest and longest wave in Elliott Wave Theory. This is when most investors realize the new trend and rush into the market. The third wave is never shorter than the first and fifth waves.

- Characteristics:

- Volume increases, and prices move rapidly.

- Most market participants recognize the new trend and open positions.

- The wave subdivides into 5 smaller waves.

4th Wave (Corrective)

The fourth wave is a corrective move following the third wave. It is usually sideways and more complex. Since most investors have profited from the third wave, there is less volatility and movement in this wave.

- Characteristics:

- Typically short and complex.

- Retraces part of the third wave’s gains but never touches the start of the third wave.

- The wave subdivides into 3 smaller waves.

5th Wave (Impulse)

The fifth wave represents the final push in the trend and often marks the end of the movement. This wave usually reflects over-optimism in the market, where investors jump in too late, unaware that the trend is nearing its peak.

- Characteristics:

- A final rise after the fourth wave, though volume typically decreases.

- The market often enters an overbought zone.

- The wave subdivides into 5 smaller waves.

Elliott Wave Plans

Elliott Wave Plans