Harnessing the Power of Elliott Wave Theory

In the complex and often unpredictable realm of financial markets, robust analytical tools are indispensable for guiding investors. Elliott Wave Theory is one such tool that not only analyzes numerical data but also reflects the emotions and collective behavior of market participants.

Elliott Wave Theory and Market Cycles

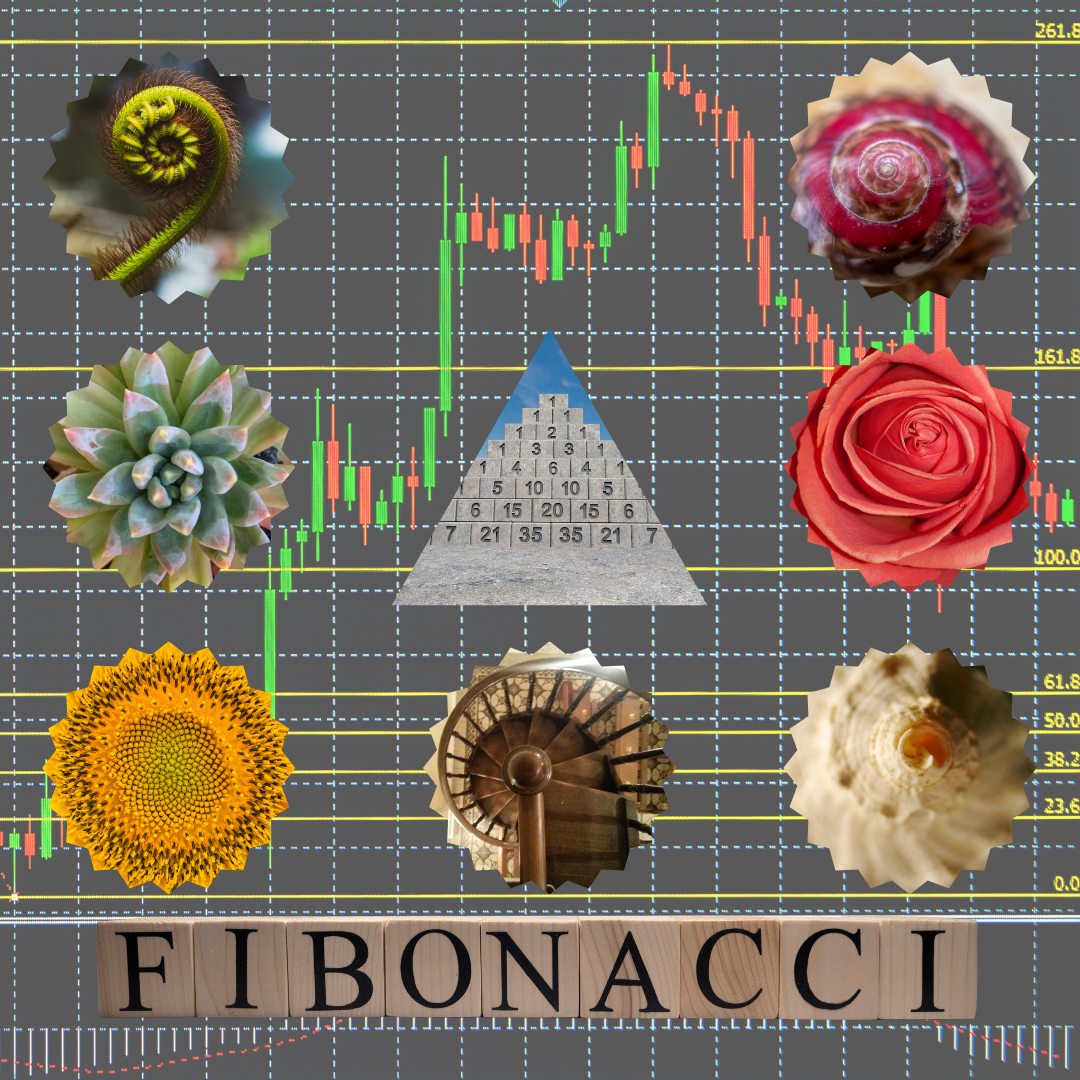

Elliott Wave Theory posits that market movements follow specific, repetitive wave patterns. These patterns define cycles of upward trends, corrections, and renewed upswings, mirroring the collective sentiment of investors. Each wave is governed by specific rules and ratios, such as those derived from Fibonacci relationships, which help predict future market movements.

Understanding these wave patterns goes beyond mere numerical analysis—it involves interpreting the underlying psychology of the market. This unique combination of mathematical precision and behavioral insight is what makes Elliott Wave Theory a compelling tool for modern financial analysis.

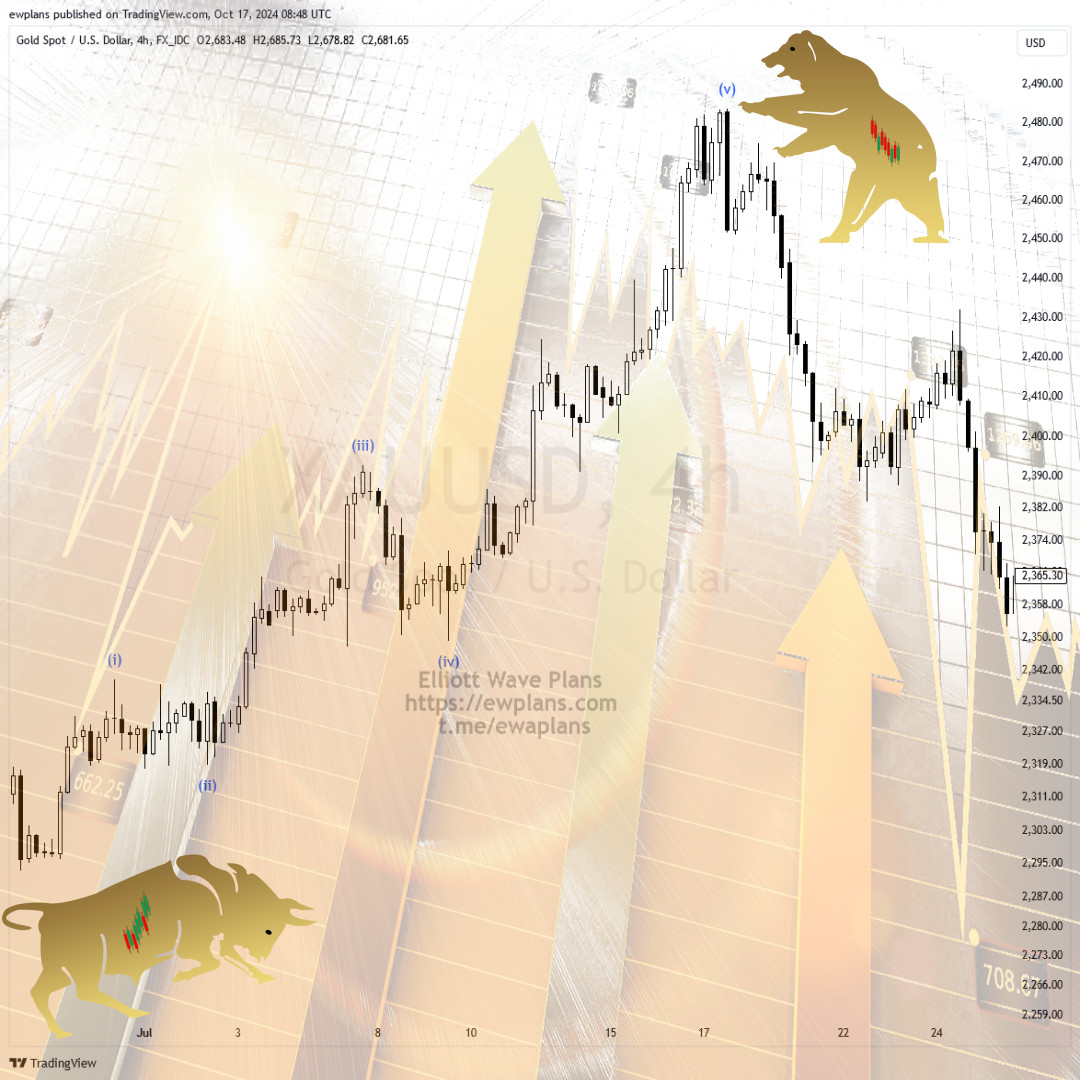

Real-Life Application: Riding the Waves

Consider a market that has experienced a prolonged upward trend, where most investors are optimistic. At the start, the first wave may be subtle as only a few investors spot the new trend. However, as the third wave gains momentum, mass participation drives the market to new highs, and the fifth wave may signal an impending correction due to over-optimism.

In practical terms, identifying these waves and applying Fibonacci ratios can offer critical entry and exit points for trades. For example, when the second wave retraces about 61.8% of the first wave, it often marks an opportune moment to buy. Such real-world applications illustrate the power of Elliott Wave Theory as an analytical tool.

The Role of Investor Psychology

Market movements are not merely numbers on a chart—they are also a reflection of human emotions. Elliott Wave Theory reveals how investor sentiment can drive price fluctuations, particularly during the impulsive third and fifth waves. Recognizing these emotional shifts helps investors make more informed decisions by combining technical analysis with an understanding of market psychology.

Advantages and Limitations of Elliott Wave Theory

Advantages:

-

Comprehensive Analysis: Integrates both technical data and investor psychology for a holistic market view.

-

Predictive Power: Utilizes Fibonacci ratios and wave patterns to anticipate market reversals.

-

Flexibility: Adaptable to different market conditions and asset classes, whether in rising or falling markets.

Limitations:

-

Interpretation Challenges: Correctly counting and interpreting waves requires experience and practice, and different analysts may offer alternate counts.

-

Uncertainty: Market movements don’t always conform neatly to wave patterns, which can lead to ambiguous signals.

-

Complementary Tool: Best used in combination with other technical and fundamental analysis tools.

Integrating Elliott Wave Theory into Your Strategy

To effectively incorporate Elliott Wave Theory into your trading strategy, consider the following steps:

-

Solidify Your Basics: Review the FAQs and foundational documents to master the core concepts of wave patterns and Fibonacci ratios.

-

Practice Rigorously: Apply wave counting on real market data and analyze different scenarios.

-

Develop a Personalized Strategy: Combine Elliott Wave insights with other technical indicators to optimize risk management and trade timing.

-

Seek Feedback: Validate your analysis against historical data and adjust your strategy as needed.

Conclusion

Elliott Wave Theory offers a powerful means to navigate market cycles by blending mathematical analysis with investor psychology. Whether you are a novice or an experienced trader, understanding and applying these wave principles can provide a significant edge in reaching your investment goals. Embrace the theory to unlock new opportunities and steer your financial journey with confidence.

Elliott Wave Plans

Elliott Wave Plans