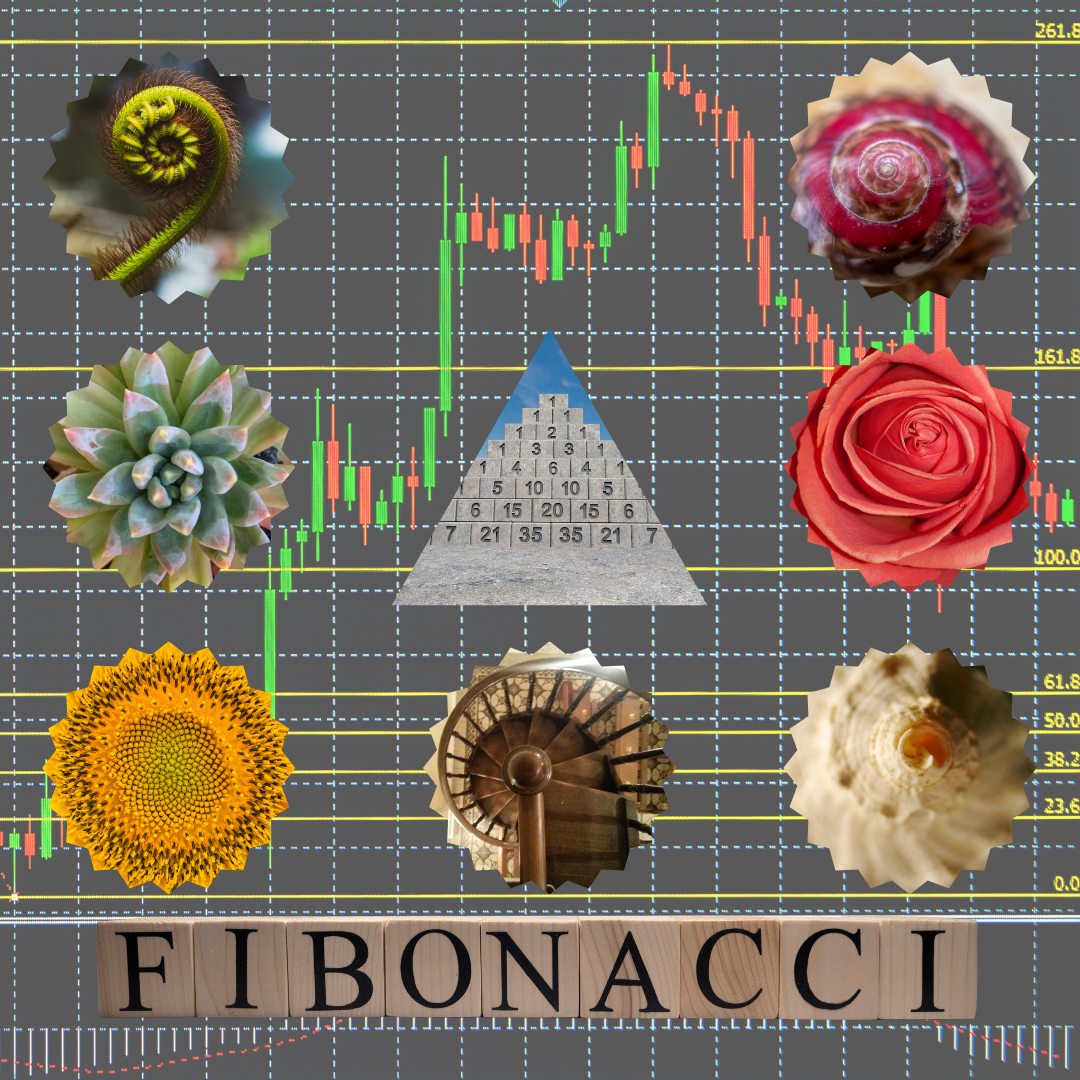

When analyzing financial markets, the Fibonacci Sequence and the Golden Ratio hold an important place among the technical tools. These concepts demonstrate that, as in nature and art, a certain order exists in the financial world, and price movements follow a predictable pattern. So, what are the Fibonacci Sequence and the Golden Ratio, and how are they used in trading?

What is the Fibonacci Sequence?

The Fibonacci Sequence is a series of numbers where each number is the sum of the two preceding ones. This sequence goes 1, 1, 2, 3, 5, 8, 13, 21, 34... As the numbers progress, the ratio between two consecutive numbers approaches the Golden Ratio, which is approximately 0.618.

What is the Golden Ratio?

The Golden Ratio (phi: 1.618) is a mathematical constant frequently seen in nature and many repeating forms. From the arrangement of leaves on plants to the spiral of seashells, from architectural designs to art pieces, traces of this ratio can be found. The same logic applies in financial markets; price movements and fluctuations tend to follow certain ratios.

Fibonacci Retracement Levels

The most common use of the Fibonacci Sequence in financial markets is through Fibonacci Retracement Levels. These levels are used to predict how much a price will pull back after a major move. The most common retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Traders rely on these levels as potential support and resistance points in their decision-making.

For instance, after a stock makes a significant price surge, it is expected to pull back by 61.8%. This retracement can offer new entry points or opportunities to close positions.

Fibonacci Extension Levels

The Fibonacci Sequence is also used for price extensions, not just pullbacks. If an asset is moving in a strong trend, Fibonacci extension levels are used to predict how far the price might rise. These levels are 161.8%, 261.8%, and 423.6% and provide insights into how much further a trend might extend.

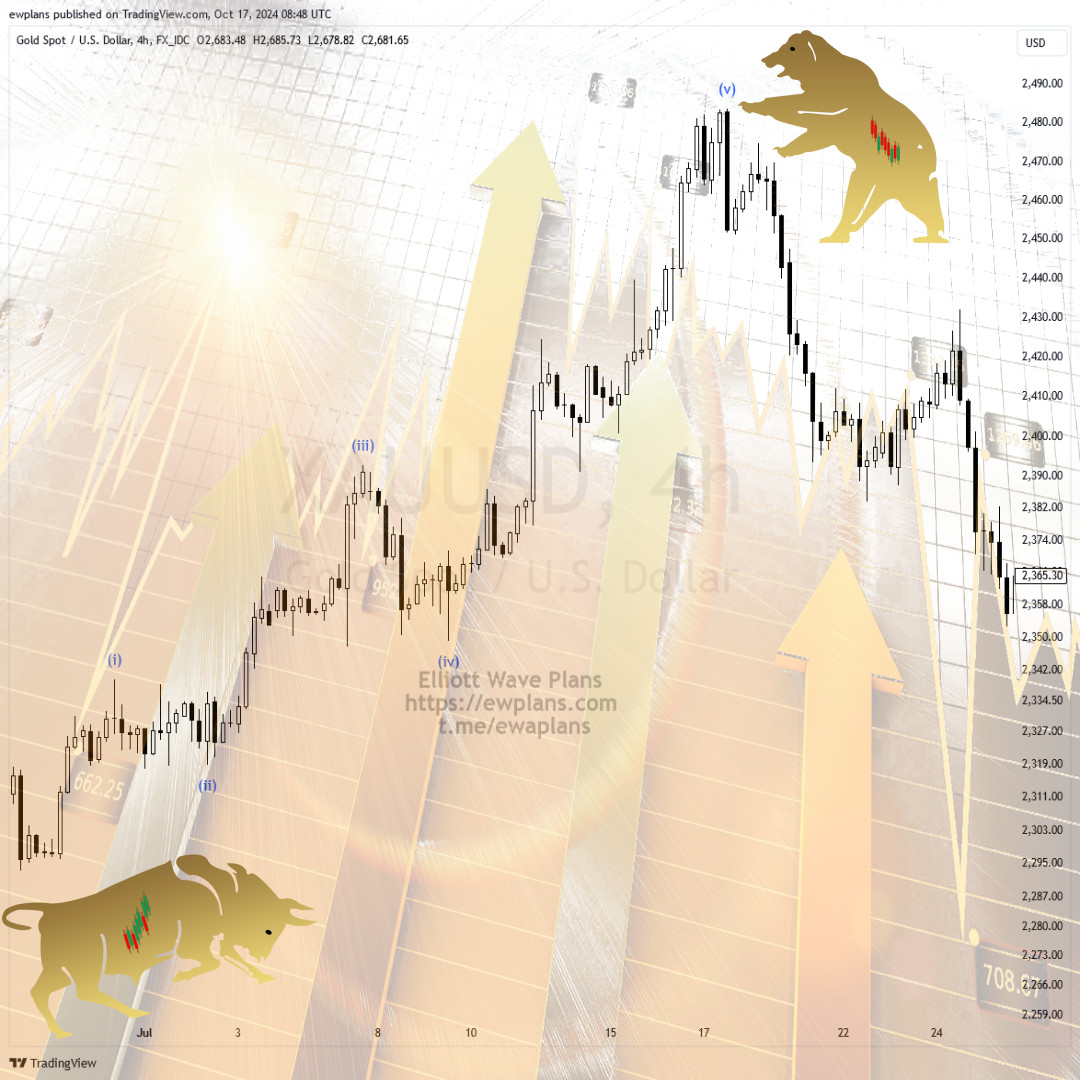

Fibonacci and Elliott Wave Theory

There is a strong connection between the Elliott Wave Theory and the Fibonacci Sequence. Elliott Wave structures (impulse and corrective waves) often relate to Fibonacci ratios. For instance, in Elliott Theory, the third wave usually extends to 1.618 times the first wave. The fourth wave often retraces 38.2% or 50% of the third wave. These ratios offer traders important clues about how long market fluctuations might last.

The Use of Fibonacci and the Golden Ratio in Trading

Using Fibonacci ratios in trading forms a crucial strategy in technical analysis. Fibonacci retracement levels help traders determine optimal entry and exit points. In high-volume markets, these levels often strengthen support and resistance zones.

The Golden Ratio, on the other hand, is used to identify harmonic formations and symmetrical structures in markets. This ratio helps traders detect precise points in their trading strategies, allowing for lower-risk entries and exits.

Keys to Successful Trading with Fibonacci

Effectively using Fibonacci tools is essential for successful trading. Here are some tips for utilizing Fibonacci strategies:

-

Watch Fibonacci Retracement Levels: After a strong price move, a retracement is likely. Identifying these levels can help you capture favorable buying or selling opportunities.

-

Use Multiple Timeframes: Analyzing Fibonacci levels across different timeframes provides a broader perspective and prevents false signals.

-

Combine with Support and Resistance: Fibonacci levels offer stronger signals when they overlap with existing support or resistance zones. This combination can help you create more secure trading strategies.

-

Integrate with Elliott Wave Theory: Using Elliott Wave Theory in conjunction with Fibonacci analysis allows you to understand the relationships between waves and better predict market trends or reversals.

This detailed blog post explains the significance of Fibonacci Sequence and the Golden Ratio in financial markets, offering traders insight into how these tools can enhance their trading strategies.

Elliott Wave Plans

Elliott Wave Plans