Achieving success in financial markets requires more than just following trends. Understanding market behaviors and predicting future movements demand a strategic perspective. Elliott Wave Theory is a powerful method that steps in precisely at this point to analyze market movements.

The Basics of Elliott Wave Theory

The Elliott Wave Theory was developed in the 1930s by Ralph Nelson Elliott. Elliott observed that markets, though appearing chaotic, actually follow specific, repetitive wave patterns. These waves form as a result of investor psychology and collective emotional responses. According to the theory, markets move in a cycle where investors shift from optimism to pessimism and then back to optimism.

Wave Structure

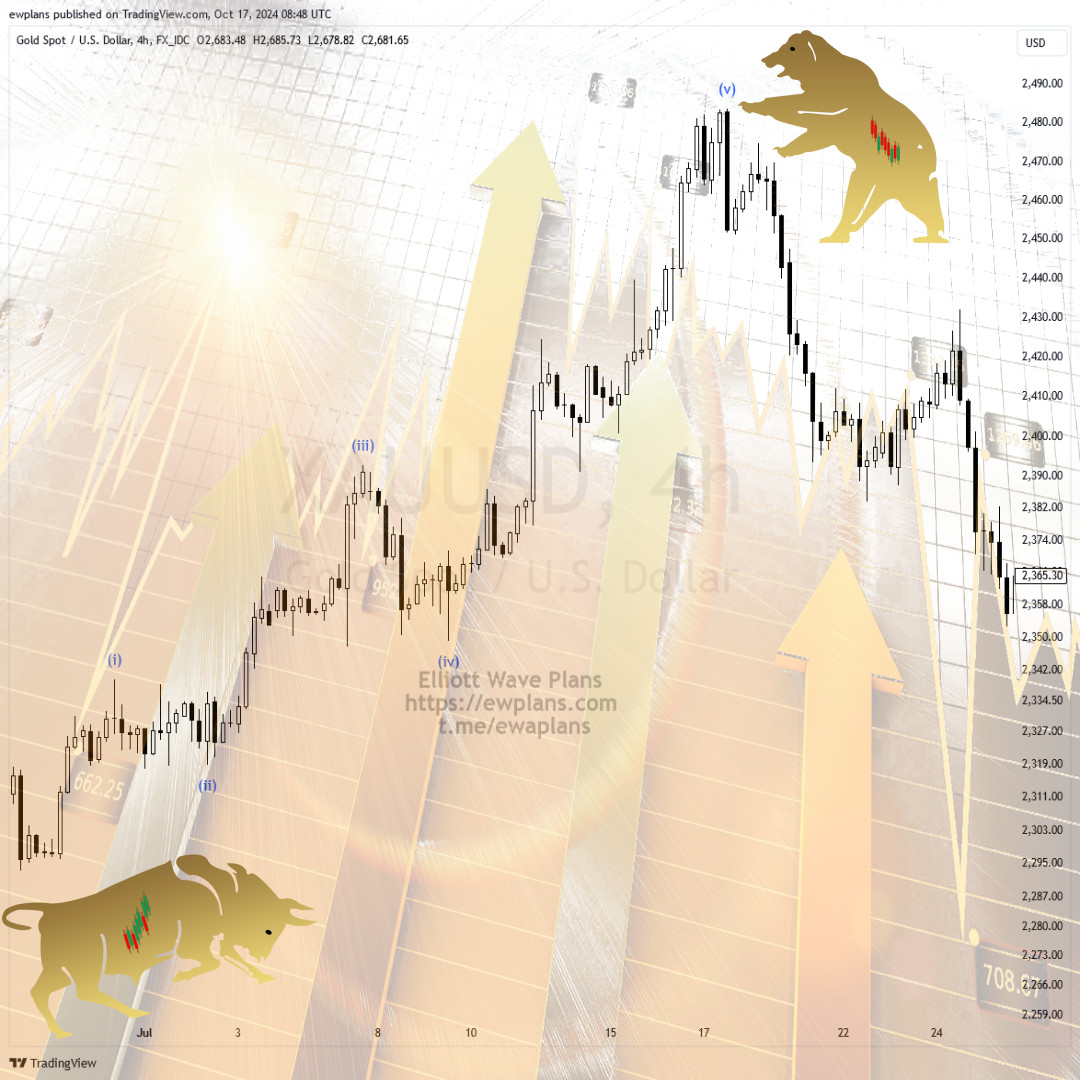

The Elliott Wave Theory states that markets move in a "5-3 wave" pattern. The first five waves move in the direction of the trend (impulse), while the next three waves (corrective) usually move in the opposite direction. This structure can be summarized as follows:

- Impulse Waves (1-5): These waves occur when the market is moving in the direction of the trend. They are typically observed during times of investor optimism and rising prices.

- Corrective Waves (A-B-C): These waves move against the trend and often reflect market corrections, where prices might decline or stabilize.

Market Cycles and Psychology

One of the most important aspects of the Elliott Wave Theory is its foundation on investor psychology. As investors believe the market will rise, they buy, and this optimism triggers wave formations. Similarly, fear and panic during market declines lead to opposing wave movements.

Trading with Elliott Wave Theory

This theory can be used in technical analysis to predict market directions. By analyzing wave structures, you can develop trading strategies to anticipate the beginning or end of a trend. However, to use Elliott Wave Theory effectively, detailed knowledge and practice are essential.

Conclusion

Elliott Wave Theory is a powerful tool for understanding market movements and predicting future trends. By combining wave patterns with investor psychology, it allows for a more strategic and disciplined approach to markets. If you learn to trade using this theory, it can significantly enhance your understanding of market movements.

Elliott Wave Plans

Elliott Wave Plans